Jeff Barr, a Web Services Evangelist at Amazon, just published some interesting data that is supporting the observation that IT operation outsourcing is being leveraged aggressively. It also shows that this switch is happening incredibly quickly. For those in the business, this is not surprising because our customers have been screaming for more performance/capacity for a decade, mostly because the processor vendors such as Intel and IBM have not been able to provide anywhere near the performance improvements required to keep up with the data explosion.

From Amazon's 4th quarter earnings call, TechCrunch reports that the businesses that are taking advantage of IT operation outsourcing are not just tiny little start-ups:

"So who are using these services? A high-ranking Amazon executive told me there are 60,000 different customers across the various Amazon Web Services, and most of them are not the startups that are normally associated with on-demand computing. Rather the biggest customers in both number and amount of computing resources consumed are divisions of banks, pharmaceuticals companies and other large corporations who try AWS once for a temporary project, and then get hooked."

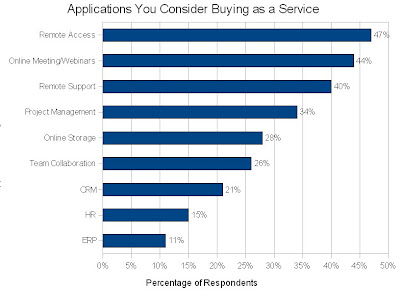

The value that is created by the on-demand capacity inherent to Cloud Computing is the big differentiator here for both startup and established business. For startups the value is inherent to the service, but for the mid-market it is on-demand capacity. To understand this, one must realize that most compute problems are bursty: it takes humans time to formulate experiments and setup the automation, but from that point on compute capacity and performance are the critical path.

In today's shift towards extracting more value out of operational business data, the mid-market is about to embark on a whole new degree of productivity; Cloud Computing and the pay-as-you-go business model removes IT operation, both CapEx and OpEx, as the limiter for all business: small, medium, and large. With this type of value creation, the switch-over can happen dramatically quickly.